The sale of Corbis to Unity Glory, a Beijing China headquartered company, and the simultaneous announcement that Getty has an exclusive global distribution partnership with the parent company — Visual China Group, foretells the continued demise of the stock photography industry, and as well, Getty Images.

|

| Corbis website announces sale. |

One of the things that is remarkable about this, is that the following sentence appears at the beginning of a press release on the Corbis website:

«NEW YORK (January 22, 2016) — Getty Images, the world leader in visual content and communications, and Visual China Group («VCG»), a leading Chinese visual communications and new media business, today announced an exclusive distribution partnership that will enable Getty Images customers to access the extensive visual library from Corbis Images.»

Later the press release states:

«VCG and Getty Images will immediately begin work to migrate Corbis content, with migration to be completed as quickly as possible to ensure a seamless transition for customers, contributors and other partners.»

The «Spotlight on» section of the front page lists several links:

|

| Announcement of VCG acquisition and Getty Images exclusive deal on front page of Corbis website. |

Consider the optics of the above. Corbis is calling Getty «…the world leader…» Corbis is no longer competing with Getty, this sentence alone makes that clear. So why do this? Simple. Anti-trust.

Several years ago, Getty investigated the viability of buying Corbis directly, according to sources familiar with the due-diligence efforts at the time. However, both U.S. and U.K. anti-trust laws prevented it at a time when Getty was trying to acquire both Corbis and Rex Features. This joint announcement of the sale of Corbis to a Chinese company, and, simultaneously, the announcement of the exclusive distribution partnership is clearly an effort to skirt anti-trust laws.

November 3rd, 2015 Getty announced they struck a deal with creditors, which, as Bloomberg aptly notes has «…been struggling for cash amid a price war with newer rivals, is getting a lifeline from investors known for profiting from distress.» (Distressed-Debt Lenders Aid Getty Images in Battle Against Shutterstock, 11/4/15).

The fact that there are 84 days between these announcements should belie the real situation. The certainty of the deals announced on January 22, 2016 was almost certainly the reason that Getty received the additional round of funding. As Getty Chairman Jonathan Klein tweeted (and then deleted):

Getty co-founder Jonathan Klein boasted about the acquisition of the exclusive rights deal on his twitter account. Let’s dissect his tweet. «Almost 21 years, but got it.» — He’s referring to his long-term plan to acquire Corbis Images. «buying the cow» refers, of course, to a purchase of Corbis outright. He’s happy he didn’t have to buy it. Now comes the really offensive part: «the milk, the cream, cheese, yoghurt and the meat» — what exactly is he referring to? That’s right, the intellectual property rights to the material produced by Corbis photographers. Getty now has the exclusive worldwide distribution deal for all of Corbis’ content. For anyone owning or being a distribution partner of Corbis, what does this mean?

Here’s how it worked previously for an individual photographer:

$ 100 image gross image licensing fee

$ 50 goes to Corbis

$ 50 goes to photographer

Here’s how it will work now for an individual photographer:

$ 100 image gross image licensing fee

$ 50 goes to Getty

$ 50 goes to Unity Glory/Corbis$ 25 Unit Glory/Corbis keeps

$ 25 goes to photographer

So if you’re an individual photographer represented by Corbis, EVERY image licensing fee you will get will now be half of what it was. (this assumes the standard 50/50 deal, some places are 60/40).

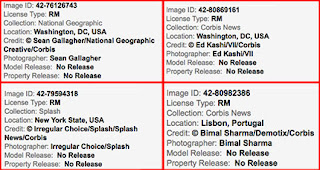

It gets worse if you’re part of a distribution deal that Corbis has with other agencies. For example, here are four of the many agencies affected by this deal:

|

| A few of the many Corbis partner agencies |

How will they be affected:

$ 100 image gross image licensing fee

$ 50 goes to Corbis

$ 50 goes to sub-agent

$ 25 sub-agent keeps

$ 25 goes to photographer

Here’s how it will work now for an individual photographer:

$ 100 image gross image licensing fee

$ 50 goes to Getty

$ 50 goes to Unity Glory/Corbis$ 25 Unity Glory/Corbis keeps

$ 25 passes to sub-agent$ 12.50 sub-agent keeps

$ 12.50 goes to photographer

If you’re a photographer currently represented by a sub-agent who distributes through Corbis, or even directly with Corbis, assuming all other things being equal, you’ll want to cancel your representation by the sub-agent or with Corbis, and transfer all your images to a Getty contract. This seems to be the only way you’ll keep your revenue percentages. There’s nothing anti-trust that would jeopardize Getty when individual photographers (or even agencies) move to Getty directly and cut Corbis out the the middle. With all content on Getty from Corbis in short order, it’s not going to change your sales quantities, just your net bottom line revenue.

What is not clearly known is what investor arrangement Getty has with VCG behind-the-scenes, if any, beyond the revenue share from each license. How has Getty and the Carlyle Group (NASDAQ: CG) structured this deal? And, to what extent is there a financial arrangement that could risk an anti-trust claim between Carlyle and VCG? Further, this will increase Getty’s library substantially, but only at a percentage of the total. With Getty as a subsidiary of Carlyle and VCG a Chinese company that can’t really be reached by U.S. anti-trust claims, Carlyle could be in a position where they are left holding the bag on an anti-trust charge, even years after Getty Images is gone (or sold) and no company that might be interested in acquiring Getty Images from Carlyle would be interested in purchasing the liability of an anti-trust lawsuit, which would then make Getty’s position with VCG a poison pill for as long as the shadow of anti-trust issues persist. The revenue share between VCG and Getty is not known, but Getty will only be getting a percentage — is that going to be enough for Getty to survive? Likely not, it will just stem the bleed-out of the dying corpse.

One other thing that will come up is how Getty Images ranks search results. When Getty Images assigns a photographer to cover the Tony Awards in New York City, they will also be distributing the images from Agence France Presse. Getty just announced yesterday — Getty Images and AFP renew leading content partnership (1/25/16). An AFP staffer may not care that this deal happened, if they’re not getting a revenue share from the licensing of their staff-produced content, but make no mistake about it, if a Getty, and AFP photographer are covering the Tony Awards, Getty wants their content to appear first in search results because they don’t have to share the revenue with AFP if an editor

No comments:

Post a Comment